The Global Economic Repercussions of President Trump's Tariffs: Fragmentation in Global Trade

Really Chakma | 30 April 2025

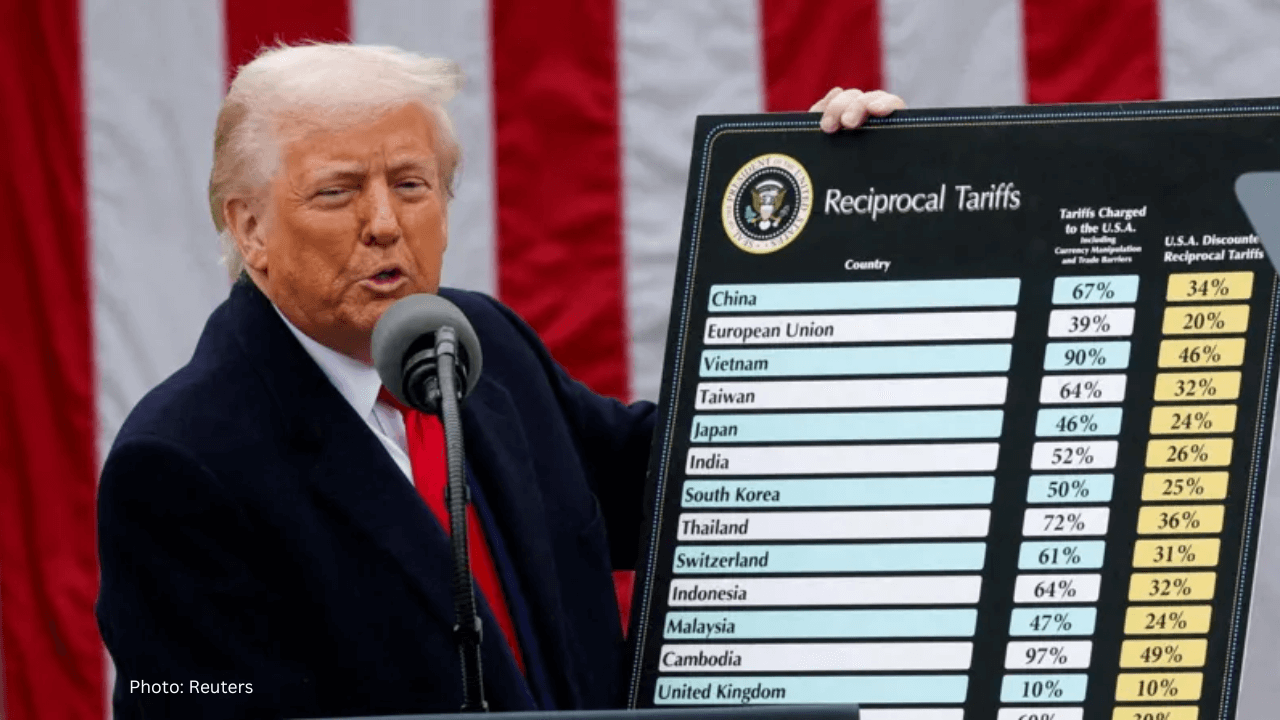

U.S. President Donald Trump announced a comprehensive executive order in April 2025 that imposed a baseline tariff of 10 percent on all imports into the United States. The tariffs on 57 targeted countries, including a 104 percent duty on Chinese imports, ranged from 11 to 50 percent. This protectionist action caused global economic consequences in the areas of financial markets, trade flows, inflation, and macroeconomic stability. It also represented a substantial break from post-war trade liberalization norms. A rising amount of research indicates that the long-term costs, both domestically and internationally, may exceed the projected benefits, even if the Trump administration defends these tariffs on the basis of trade imbalances, national security, and industrial rebirth.

Depending on the dynamic economic feedback taken into account, President Trump's tariffs are expected to bring in between $3.2 trillion and $5.2 trillion in revenue over the course of ten years. The impact on net revenue is extremely sensitive to foreign retaliation, according to research from the Peterson Institute for foreign Economics (PIIE). A 15% tariff may generate $3.2 trillion in net income in the absence of response. However, if trading partners retaliate with reciprocal tariffs, this amount would decrease to $1.5 trillion. In actuality, it is anticipated that higher tariffed costs will result in decreased real wages, decreased investment, and decreased consumption. Industries that depend significantly on trade are disproportionately affected by these consequences, including mining, manufacturing, and agriculture.

The news of the tariff elicited a strong reaction from the world's financial markets. Countries all throughout the world reacted to President Trump's 2025 tariffs with a combination of caution, policy changes, and retribution. Al Jazeera claims that within three days of the executive order, around $10 trillion in global equities value, nearly 10% of the world's GDP was destroyed. The greatest two-day drop in the history of the U.S. stock market heightened investor concerns about an imminent global trade war. Tariffs on shipments from China, the main target of the tariff escalation, increased to 104%. In response, China redirected its exports to other markets and imposed high counter-tariffs on American goods. The European Union prepared countermeasures but suspended them for ninety days to allow for negotiations. The EU was initially targeted with a 20% tariff, which was eventually lowered to 10% after a brief halt. Trade realignment and diplomatic tension resulted from the imposition of new steel and aluminum tariffs on other major economies, including Canada and Mexico. Globally, there was significant market volatility, and central banks adjusted interest rates to mitigate the effects of the economic shock, particularly in the EU and emerging countries.

Both direct economic exposure and more general regional worries about trade stability have influenced South Asia's like the other major economies. India was subject to higher taxes on important exports like equipment, textiles, and medicines even though it was not one of the most heavily targeted nations. It responded by reviewing its trade policies with the United States and establishing closer bilateral relations with ASEAN and the EU, two alternative markets. Due to its heavy reliance on U.S. garment exports, Bangladesh was immediately concerned about cost competitiveness and market access, which led to local requests for diversification and governmental support. Viewing the levies as an additional burden on its export industry, Pakistan, which was already dealing with macroeconomic issues, concentrated on controlling currency volatility and enlisting China's trade assistance.

In its April 2025 Global Financial Stability Report, the International Monetary Fund (IMF) lowered the global GDP projection from 3.3% to 2.8%, pointing to "significant" headwinds brought on by Trump's tariffs. IMF representatives highlighted two shocks: direct trade restrictions and the ambiguity they created in the world economy. Global borrowing costs are rising as a result of this uncertainty, which is also driving capital out of emerging nations. Additionally, the Economist Intelligence Unit (EIU) lowered its 2025 global GDP growth prediction to 1.9%, the lowest level since the COVID-19 pandemic. The EIU ascribes this revision to supply chain disruptions, decreasing investment, and diminishing trade flows. It predicts a 0.1% real GDP decrease in the U.S. recession, down from previous projections of 1.4% growth. The tariffs imposed in 2025 are among the most significant changes to U.S. trade policy in recent memory. Although Trump supporters contend that tariffs can protect domestic sectors, manage trade imbalances, and lessen reliance on foreign manufacturing, the empirical data shows significant economic consequences. Domestically, firms and individuals must contend with decreased investment, depressed earnings, and rising prices. Fears of a full-scale trade war and aspirations for a "zero-for-zero" tariff agreement influencing the countries towards cautious reprisal strategies.

The threat of a protracted global slowdown has been raised by trade partners' actions on a worldwide scale. Trump and the US administration have kept the tariffs on hold for 90 days, but it is almost unpredictable what the future holds for the world economy scenario. Undoubtedly the overall scenario reflects a shift toward fragmentation in global trade, where the ripple effects of protectionist policies extend well beyond national borders, reshaping international economic relations in complex and often adverse ways.

Really Chakma is a Reasearch Assistant at CGS

Views in this article are author’s own and do not necessarily reflect CGS policy.